Real estate is a complex universe of a lot of unknowns and a quickly evolving marketplace. With a per deal size of a real estate transaction running easily into 6-digits or beyond, it is essential to be privy to crucial details that may not be readily apparent when purchasing a property. Such hidden details can nosedive the financial merits of a deal, turning a plausible income-generating asset into an income-devouring asset.

A way to ensure that an investor is getting value for money is by undertaking pre- and post-offer due diligence to avoid any unpleasant surprises. Due diligence in real estate revolves around the notion of investigating each aspect of the physical as well as the financial condition of the property.

We break down the real estate due diligence process into 3 main steps:

1. Deep Dive into Documents

The foremost step in due diligence of real estate goes beyond the matters related to the property. Before proceeding into any form of negotiations, it is vital to be aware of the reputation and track record of the seller. The full vetting of the seller may unearth facts that can sour the idea of the purchase altogether, e.g., a seller may be subject to money-laundering investigation or is a wanted criminal which could lead to possible seizure of the property by enforcement authorities.

1. Start with Basics

To begin real estate due diligence, a crucial element to understand is the transaction’s objectives. The investment mandate sets the foundation to determine the form of due diligence to be pursued. A residential property buyer may be more inclined to verify existing tenant leases to ensure continuity of rental income whereas a commercial property buyer’s primary focus may be on the intended use of the property and as to whether the purpose can be modified; hence, it is vital to be aware of the investigative lens utilised to review the property.

Furthermore, buyers should always inspect a potential purchase in person as it allows for a more holistic understanding of the property and its surroundings. E.g., a buyer plans to turn vacant land situated in a hilly area into a shopping complex; thereby, adding potential environmental costs to the development of the property.

2. Deep Dive into Documents

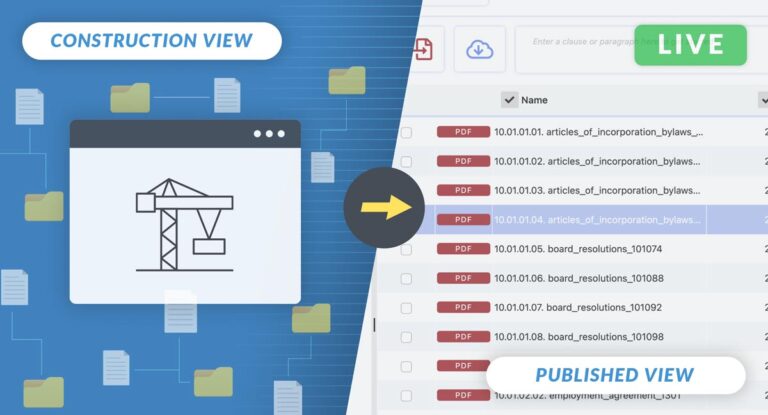

At the risk of sounding blunt, owning a property is as much as holding a title deed to that property as in the absence of the latter, ownership rights are not recognised and enforceable. Therefore, numerous legal documents such as title deeds, leases, zoning regulations, tax certificates, surveyor’s reports, etc. must be assessed, evaluated, and verified. All these documents should be securely shared via a virtual data room (VDR) during real estate transactions.

Proper understanding of these documents can provide vital clues for the determination of investment versus potential return thesis. Moreover, the very same information can act as leverage during price negotiations.

Due diligence for real estate is similar yet unlike various other types of due diligence. Related as it requires the same set of analytical and investigative skillset that is usually needed in corporate due diligence, but different as it requires a clear understanding of investment objectives and thorough knowledge not just of the property but of the surroundings too