The deluge of data in the last decade

The massive increase in data over the past decade has significantly impacted the Due Diligence process in M&A. The volume of data that companies now have related to operations, customers, financials, etc. has exploded. This means more data to collect, process, and analyse during Due Diligence. The IDC predicted that the Global Datasphere will grow by ca. 27% per annum to a whopping 175 Zettabytes (175 billion terabytes) in 2025.

What this means for due diligence

The exponential growth in data has made Due Diligence more intensive, complex, time-consuming and critical for deal success. The aim of DD is to identify any areas which would pose a threat to the deal, as well as to assess the true value of the deal. In the past, sampling exercises would be undertaken to reduce some of the time required, but in a legal landscape ever increasing in risk and complexity the consequences for missing something are too high. We’ve historically seen grave errors made during Due Diligence exercises. For example, HP’s $11.1 billion acquisition of Autonomy which ultimately ended in a loss of $5 billion. Whilst the loss was agreed to have been largely attributed to misleading information in Autonomy’s accounting, HP’s insufficient Due Diligence under time pressure was also identified as a cause.

The role of technology

There is a need for technology which supports the teams conducting Due-Diligence exercises, not only to reduce the time required for the exercise, but also to ensure that risks are captured effectively. The key is using technology to work faster, conduct deeper analysis, collaborate better and make the DD process more robust and efficient. This allows dealmakers to make better informed decisions on M&A transactions.

The role of AI technology in finding information

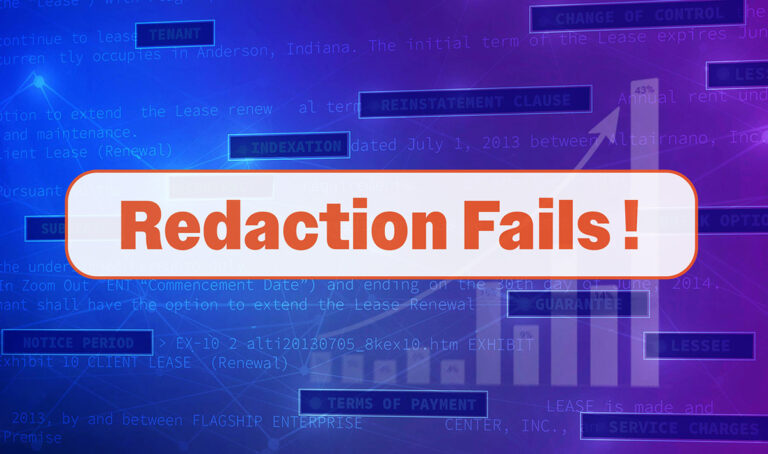

At lot of time in Due Diligence is spent with junior lawyers trawling through the mountains of contracts in the data room to identify any potential risks. Gartner says “the average time to close an M&A deal has risen more than 30 percent in the last decade.” Due to the lack of standardisation in drafting contracts, and the nature of cross-border deals, provisions can be worded very differently, thus making the identification of provisions time consuming and error prone. Using a simple keyword search can help, but often misses crucial context and semantics. This is where AI-based technology can really step in, provided it is Large Language Model (LLM) -based AI, as we will discuss in more detail later in the series.

The ability for Machine Learning to understand the linguistic patterns and context of provisions in documents is of great benefit to the Due-Diligence process. Using LLMs and other techniques, users can quickly identify elements such as the parties to the contract, the contract start and end dates, what happens in the event of a change of control, any contracts that automatically renew, and any other provisions of relevance to the exercise.

Utilising AI to produce summaries of whole portfolios of documents greatly reduces the time spent on manually searching through the documents, and reduces the chance that something is missed.

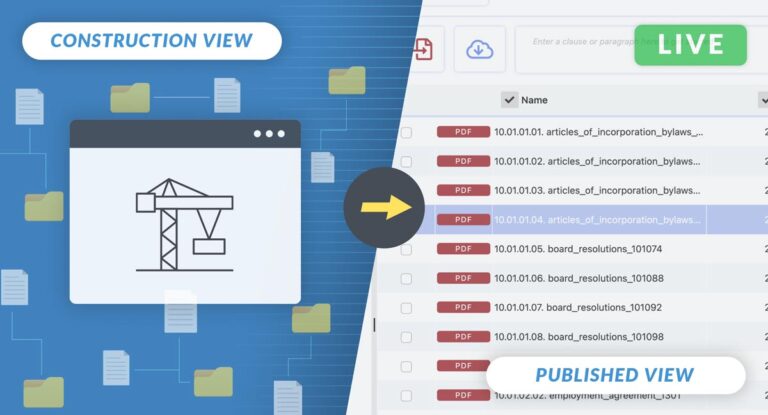

Stay tuned for next week’s post where we discuss why these technologies are best situated within virtual data rooms…

Are you looking for a VDR with fully integrated redaction software which leverages AI? Speak to our sales team or check out our Smart Summaries page here.