Written by: Amir Khan

Before the arguments start for and against using cloud storage or a Virtual Data Room for your due diligence process, let’s discuss the big fat elephant in the room.

Imprima is the leading provider of virtual data rooms.

Even though that is the case, I am not going to end this blog by concluding that virtual data rooms are the only choice available for the due diligence process, and you shouldn’t be looking at alternatives.

My intention here is to provide you an honest perspective on the differences between using a dedicated virtual data room for your due diligence process and using a cloud storage provider.

Without further delay, let’s look at the benefits and hazards of using a cloud storage system (such as Dropbox) for your due diligence process.

Cloud Storage Systems

Pros of using cloud storage for Due Diligence

- Easy and quick access to documents, which can be shared instantly, thereby eliminating process inefficiencies and document duplication.

- Offered free of charge for a relatively low fee with increased usage (freemium model).

- SaaS-based file sharing and storage has become extremely popular as you can share sensitive information via a group email.

Cons of using cloud storage for Due Diligence

- Security Risks and limited change control, if at all. Users can delete data which will also delete it for the owner of the data as the data within the platform is synchronised. DropBox (as an example) was also hacked with 68 million user passwords leaked[1].

- Users can share data with others, without the owner’s permission. This can be a big issue if you’re expecting to have a large amount of interested parties accessing your confidential documentation.

- The deal manager has limited tools available to control the data handling of users.

- The deal manager is not protected against making mistakes themselves, such as prematurely sharing data, or accidentally sharing data with the wrong people.

- These actions are not always recorded against a compliance feed, so you have no traceability or accountability to rely upon.

Virtual Data Room Providers

For the sake of a fair argument here, I’ll be looking at an aggregate view of all virtual data room providers as many virtual data room providers offer different sets of functionalities.

Pros of using a Virtual Data Room Provider for Due Diligence

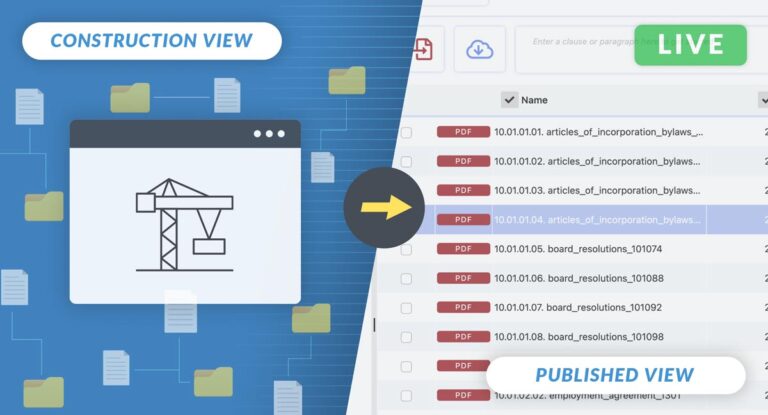

- Deal managers are protected from making mistakes such as inadvertently sharing information with the wrong users due to the fail-safe sharing functionality of certain virtual data rooms.

- Granular tracking is a major advantage of using a virtual data room for due diligence. Having the ability to know who is viewing your document, when they viewed it and how often they have viewed it gives you a sense of what is important during the deal.

- You’ll want to make sure that your virtual data room provider is exempt from the US Freedoms Act to ensure that your files are explicitly safe.

Cons of using Virtual Data Room Provider for Due Diligence

- Generally, there is a lot of functionality available which can cause a trade-off between security and user experience. You’ll want to make sure your virtual data room provider has 24/7 support and that they speak your language so if you get stuck, help is a phone call away.

- Virtual Data Rooms are built specifically for the due diligence process so the higher level of functionality and security can result in a higher fee than that of cloud storage services. However, the ‘Institute of Mergers, Acquisitions and Alliances’ advocates that a Virtual Data Room adds value to your deal.[i]

So, which will deliver your due diligence process a better ROI?

Both cloud storage services and Virtual Data Rooms can deliver a great ROI for your due diligence process, but it all comes down to what is best for your deal. Many businesses are using cloud storage services for smaller deals that do not have various parties involved so document tracking isn’t a huge issue for them. Dropbox, for example, was principally designed as a consumer service and in my opinion, it has not evolved fundamentally since.

It is important you understand the intricacies of your due diligence process, so you’re best placed to make a decision. If you plan on having multiple parties involved during the deal and security is a top concern to you, then a virtual data room should will more often than not, be the best fit.

Due to the higher cost in a dedicated virtual data room than that of a cloud storage provider, it can be difficult to convince your c-suite executives to change their existing tactics.

With the finest minds in due diligence software, Imprima can simplify and streamline your due diligence processes. We work with M&A teams, Financial Advisors, Legal Advisors, and Real Estate professionals to help manage their processes and limit deal protraction. This helps you stack the deck in your favour, for each and every transaction.

If you would like to discuss how you can simplify your current due diligence process, chat to a member of our team today.

[i] https://imaa-institute.org/docs/kummer-sliskovic_do%20virtual%20data%20rooms%20add%20value%20to%20the%20mergers%20and%20acquisitions%20process.pdf

[1] https://www.theguardian.com/technology/2016/aug/31/dropbox-hack-passwords-68m-data-breach